Newsletter

News from Australia | Economic News | Practical Articles

Stay with us to get the latest news from Iran and Australia, useful articles on currency services, work and life in Australia, and practical information.

All Categories

- Currency and Economic News

- Immigration to Australia

- Australia facts

- Educational Articles

- Javadi Exchange News

Javadi Exchange News

Immigration to Australia

Medicare in Australia (2025): New Changes and Benefits

Medicare in Australia is evolving in 2025 with significant changes like Bulk Billing incentives, lower prescription drug costs, and higher thresholds for the Medicare Levy. This guide explains how these updates benefit you and how to make the most of your Medicare coverage.

Educational Articles

Job Opportunities for International Students in Australia (2025)

Looking for job opportunities as an international student in Australia? This comprehensive guide covers everything you need to know in 2025—work rights, common job sectors, average wages, and tips for balancing work and study while living in Australia.

Australia facts

Electricity Bills Expected to Rise in Australia

The rapid growth of artificial intelligence in Australia is increasing electricity consumption and household costs. Could nuclear energy offer a sustainable solution to AI’s endless power demand?

10 Interesting and Lesser-Known Facts About Australia

Explore 10 fascinating and unexpected facts that will give you a whole new perspective on this vast land.

Hidden Gems of Australia: Wonders Beyond the Tourist Trails

Australia is more than big cities and famous beaches! In this article, we reveal lesser-known destinations that offer unforgettable adventures in the heart of nature.

5 Dreamy Australian Beaches

Ready to experience Australia’s best beaches in 2025? From Tasmania’s Bay of Fires to Western Australia’s Cable Beach, these 5 dreamy destinations offer everything from serene lagoons to golden sands and unforgettable sunsets. Find your next beach paradise today!

Currency and Economic News

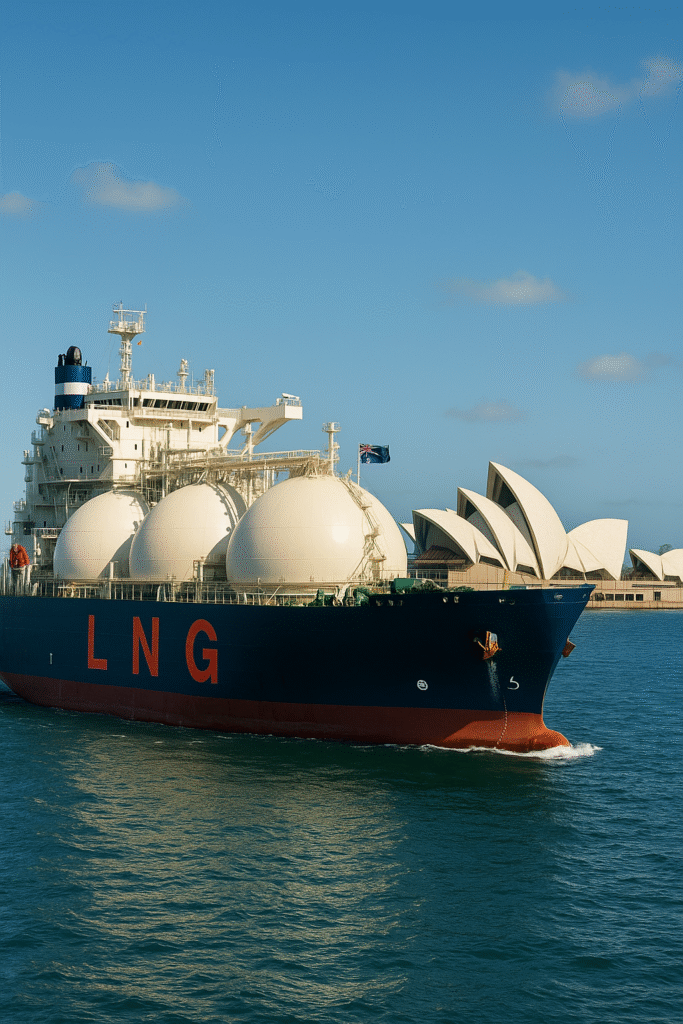

Decline in Australia’s fossil fuel export revenues by 2035

The Coming Decline: The Future of Australia’s Fossil Fuel Exports Treasury Forecast of the Decline of a Long-Standing Industry Australia has long been recognized as one of the world’s largest exporters of coal and liquefied natural gas (LNG). However, according to new Treasury modeling, revenue from these sectors is expected to decline by more than 50 billion Australian dollars by 2035, falling to less than 30 billion dollars by 2050. What Treasury Modeling Shows: The forecasts are alarming. The value of coal and liquefied natural gas (LNG) exports, currently estimated at around 130 billion Australian dollars (2025), is expected to decline by more than 60 billion dollars by 2030. By 2050, fossil fuel export revenues are projected to fall below 30 billion dollars. Regarding production: Gas and LNG production is expected to decrease by about 24–27% by 2035 and by approximately 66–68% by 2050. Coal production is projected to decline by around 42–51% by 2035 and by about 71–74% by 2050. These results remain consistent across three different scenarios: Base scenario – continuation of current policies and targets. Renewable export scenario – growth in green commodities (such as green hydrogen). Disorder scenario – no new targets or weak commitments through 2035. No matter which scenario is considered, the downward trend is clear. Main Drivers of the Decline Several key factors are driving this collapse: Falling global demand for fossil fuels, especially as countries accelerate commitments to reduce greenhouse gas emissions. New policies by trade partners increasingly aligned with global warming limits. Rising demand for green commodities such as hydrogen and green ammonia, critical minerals (lithium, nickel, cobalt), and clean metals like iron and aluminum. Implications and Risks These forecasts have serious implications for Australia: Economic risk: Falling fossil fuel revenues could create crises for industries, regions, and workers reliant on coal and gas. Need for transition planning: Fossil fuel exports may decline sooner than expected. Australia must accelerate energy transition efforts, economic diversification, retraining, and renewable infrastructure. Opportunity in the green sector: On the positive side, green exports could grow from the current 30 billion AUD to at least 80 billion AUD by 2035, reaching 109–178 billion AUD by 2050. Perspectives and Reactions Alison Rieu (Garten Institute) warned that this modeling “explodes the truth bomb,” showing that Australia must face the unavoidable decline in fossil demand. Tim Buckley (Climate Energy Finance) described it as a “gift horse” that could turn into a “resource curse.” The gas industry continues to emphasize LNG’s role in the energy transition and regional energy security, especially for Asia. However, even their own forecasts acknowledge reductions in value and volume. Path Forward To avoid being caught off guard, several actions are critical for Australia: Economic diversification: Invest in sectors poised to grow in a carbon-free world. Clear policy frameworks: Set ambitious emissions reduction targets and provide certainty for green investments. Support for vulnerable communities: Create new jobs, retraining programs, and infrastructure investments. International cooperation: Diplomacy and trade agreements will play an increasingly important role

How to Use Alipay: Full Guide to Features, Setup & Payments

A complete guide on how to use Alipay: from registration and linking cards to payments, transfers, and services for tourists and residents alike.

Dubai Launches Crypto Payments for Government Services

Visa rejections for Iranians applying to Australia have increased due to security checks, documentation issues, and policy changes. This article explores the causes, visa types, required documents, and tips to boost your visa success rate.

Inflation and Wealth: How the Rich Turn Challenges into Opportunities

While inflation reduces purchasing power for most, the rich use proven strategies to protect and grow their wealth. This article explores how they invest, borrow smartly, and earn in strong currencies to stay ahead.