Decline in Australia’s fossil fuel export revenues by 2035

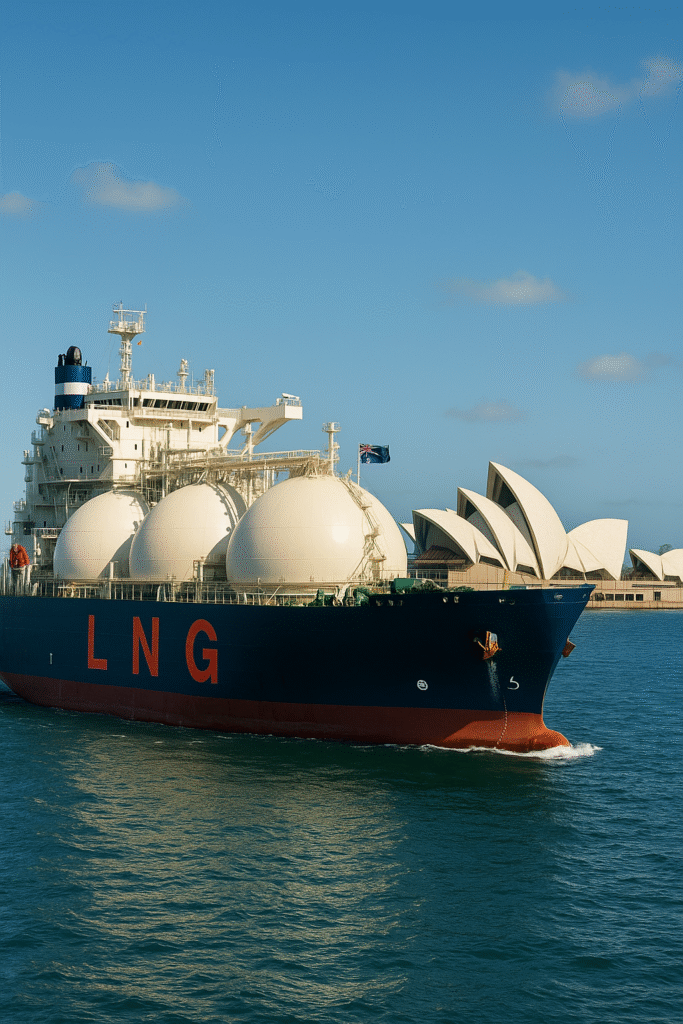

The Coming Decline: The Future of Australia’s Fossil Fuel Exports Treasury Forecast of the Decline of a Long-Standing Industry Australia has long been recognized as one of the world’s largest exporters of coal and liquefied natural gas (LNG). However, according to new Treasury modeling, revenue from these sectors is expected to decline by more than 50 billion Australian dollars by 2035, falling to less than 30 billion dollars by 2050. What Treasury Modeling Shows: The forecasts are alarming. The value of coal and liquefied natural gas (LNG) exports, currently estimated at around 130 billion Australian dollars (2025), is expected to decline by more than 60 billion dollars by 2030. By 2050, fossil fuel export revenues are projected to fall below 30 billion dollars. Regarding production: Gas and LNG production is expected to decrease by about 24–27% by 2035 and by approximately 66–68% by 2050. Coal production is projected to decline by around 42–51% by 2035 and by about 71–74% by 2050. These results remain consistent across three different scenarios: Base scenario – continuation of current policies and targets. Renewable export scenario – growth in green commodities (such as green hydrogen). Disorder scenario – no new targets or weak commitments through 2035. No matter which scenario is considered, the downward trend is clear. Main Drivers of the Decline Several key factors are driving this collapse: Falling global demand for fossil fuels, especially as countries accelerate commitments to reduce greenhouse gas emissions. New policies by trade partners increasingly aligned with global warming limits. Rising demand for green commodities such as hydrogen and green ammonia, critical minerals (lithium, nickel, cobalt), and clean metals like iron and aluminum. Implications and Risks These forecasts have serious implications for Australia: Economic risk: Falling fossil fuel revenues could create crises for industries, regions, and workers reliant on coal and gas. Need for transition planning: Fossil fuel exports may decline sooner than expected. Australia must accelerate energy transition efforts, economic diversification, retraining, and renewable infrastructure. Opportunity in the green sector: On the positive side, green exports could grow from the current 30 billion AUD to at least 80 billion AUD by 2035, reaching 109–178 billion AUD by 2050. Perspectives and Reactions Alison Rieu (Garten Institute) warned that this modeling “explodes the truth bomb,” showing that Australia must face the unavoidable decline in fossil demand. Tim Buckley (Climate Energy Finance) described it as a “gift horse” that could turn into a “resource curse.” The gas industry continues to emphasize LNG’s role in the energy transition and regional energy security, especially for Asia. However, even their own forecasts acknowledge reductions in value and volume. Path Forward To avoid being caught off guard, several actions are critical for Australia: Economic diversification: Invest in sectors poised to grow in a carbon-free world. Clear policy frameworks: Set ambitious emissions reduction targets and provide certainty for green investments. Support for vulnerable communities: Create new jobs, retraining programs, and infrastructure investments. International cooperation: Diplomacy and trade agreements will play an increasingly important role